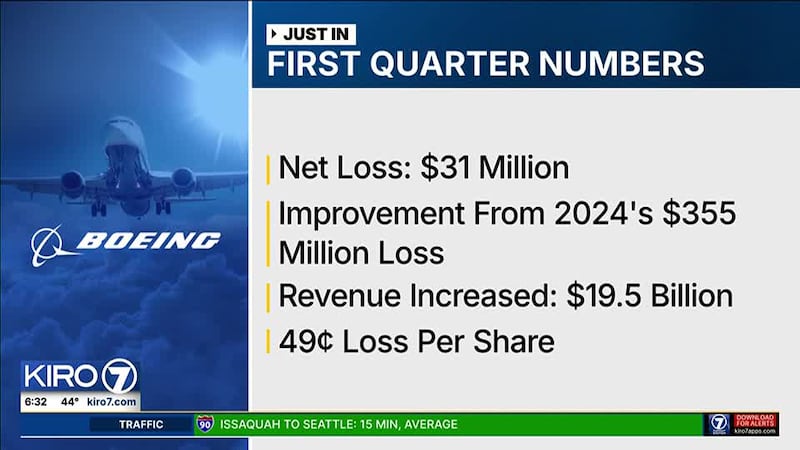

WASHINGTON — Boeing Co. on Wednesday reported a loss of $37 million in its first quarter.

On a per-share basis, Boeing said it had a loss of 16 cents. Losses, adjusted for non-recurring gains, came to 49 cents per share.

The results topped Wall Street expectations. The average estimate of eight analysts surveyed by Zacks Investment Research was for a loss of $1.54 per share.

The airplane builder posted revenue of $19.5 billion in the period, also exceeding Street forecasts. Seven analysts surveyed by Zacks expected $19.29 billion.

Boeing shares have fallen 8% since the beginning of the year, while the S&P’s 500 index has declined 10%. The stock has fallen almost 5% in the last 12 months.

Here are some highlights:

- 737 production gradually increased in the quarter; still expected to reach 38 per month this year

- Revenue increased to $19.5 billion primarily reflecting 130 commercial deliveries

- GAAP loss per share of ($0.16) and core (non-GAAP)* loss per share of ($0.49)

- Operating cash flow of ($1.6) billion and free cash flow of ($2.3) billion (non-GAAP)*

- Total company backlog grew to $545 billion, including over 5,600 commercial airplanes

KIRO 7 spoke with an aviation expert on what that means for Washington production. Our expert also breaks down a recent employee survey.

You can watch his take in the video above.

The announcement comes as Boeing announced it is selling portions of its Digital Aviation Solutions business for $10.6 billion to Thoma Bravo, a private equity firm.

Part of the sale includes Boeing’s navigation unit, Jeppesen. Jeppesen offers navigational information, operations planning tools, flight planning products, and additional software. Final bids valued Jeppesen at $8 billion, much higher than Boeing’s original wanted price of $6 billion. Strong interest from potential buyers, including TPG, Advent, and Veritas, drove the valuation higher, according to The Wall Street Journal.

Boeing acquired Jeppesen for $1.5 billion in 2000. ForeFlight, AerData, and OzRunways were also included in the sale.

The sale is a part of Boeing CEO Kelly Ortberg’s plan to reduce Boeing’s debt. Boeing claimed the sale will strengthen its capital structure and allow it to focus on core operations.

This also comes as China halted all jet orders from Boeing and instructed its airline carriers to stop buying airplane parts from U.S. companies, according to a report from Bloomberg News.

The order follows President Donald Trump’s enactment of a 145% tariff on goods from China.

More on Boeing

- Boeing offloads significant digital aviation assets in $10.6B deal

- China halts all Boeing jet orders

- Boeing’s Everett workforce impacted by latest rounds of cuts

©2025 Cox Media Group